Key Milestones in Global Currency Evolution

Explore the pivotal moments that have shaped our global monetary systems from the rise of the dollar to the emergence of BRICS.

Scroll horizontally to view all events. Click on any event to learn more.

The Dollar Era

For decades, the U.S. dollar has been the world's primary reserve currency, shaping global trade, investment decisions, and economic diplomacy. Its dominance began with the Bretton Woods Agreement and continues to influence international finance today.

The dollar's global dominance was established after World War II, when the United States emerged as the world's strongest economy. The 1944 Bretton Woods Agreement formalized the dollar's role as the world's primary reserve currency, with other currencies pegged to the dollar, which was in turn backed by gold at $35 per ounce.

Even after President Nixon ended the gold standard in 1971, the dollar maintained its central position in global finance through the petrodollar system, where oil-exporting countries agreed to price their oil in dollars and recycle their earnings into U.S. Treasury securities.

The dollar's status as the world's primary reserve currency provides significant advantages to the United States, often referred to as "exorbitant privilege." These benefits include:

- Lower borrowing costs for the U.S. government and businesses

- Ability to run persistent trade deficits without major currency depreciation

- Geopolitical leverage through control of the global financial system and ability to impose sanctions

- Reduced transaction costs for U.S. companies engaged in international trade

- Insulation from exchange rate risk for American consumers and businesses

Despite its continued dominance, the dollar faces growing challenges from several quarters:

- Growing U.S. national debt and concerns about fiscal sustainability

- Weaponization of the dollar through sanctions, pushing affected countries to seek alternatives

- Rise of competing currencies, particularly the euro and potentially the Chinese yuan

- Development of alternative payment systems that bypass dollar-based networks

- Emergence of digital currencies and blockchain technology that could disrupt traditional financial systems

The Euro Challenge

Launched in 1999, the euro emerged as the first serious challenger to dollar dominance. As the common currency of the eurozone, it united multiple European economies under a single monetary policy, creating the world's second largest reserve currency.

The euro was introduced in 1999 as a culmination of decades of European economic integration. By creating a common currency for multiple advanced economies, the European Union aimed to reduce transaction costs, eliminate exchange rate risk within the eurozone, and create a currency that could rival the dollar in international markets.

In its early years, the euro gained significant ground as a reserve currency, rising to represent about 28% of global reserves by 2009, while also becoming an important currency for international bond issuance and trade invoicing.

The 2008 global financial crisis exposed structural weaknesses in the eurozone's architecture. Without fiscal union to complement monetary union, the eurozone struggled to address divergent economic conditions across member states. Countries like Greece, Portugal, and Ireland faced severe debt crises, requiring bailouts and painful austerity measures.

These challenges revealed a fundamental flaw: the eurozone had a common monetary policy but lacked the fiscal integration and transfer mechanisms that help currency unions like the United States weather economic shocks. This undermined confidence in the euro as a stable reserve currency alternative to the dollar.

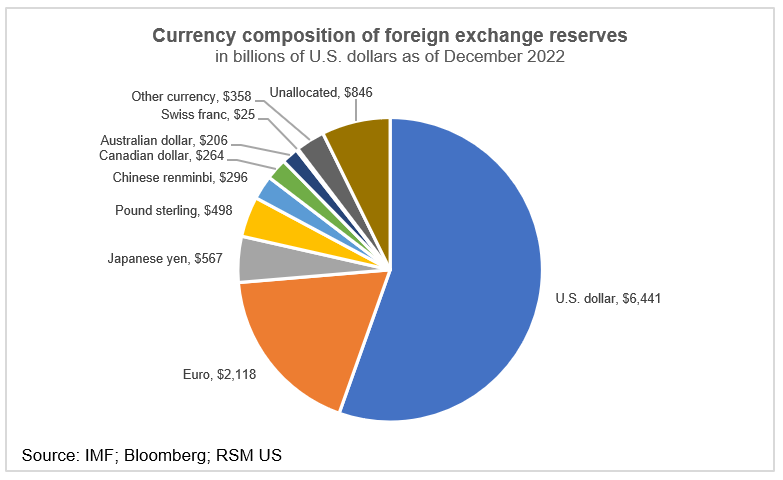

Despite its challenges, the euro remains the world's second most important currency, accounting for about 20% of global foreign exchange reserves. The European Central Bank has taken steps to strengthen the eurozone's architecture, including creating banking union and emergency lending facilities.

The euro's future as a challenger to the dollar depends on several factors:

- Progress toward greater fiscal integration within the eurozone

- Development of deeper and more liquid euro-denominated financial markets

- Expansion of the eurozone to include more EU member states

- The European Central Bank's policy choices and the euro's stability during future crises

The BRICS Alternative

The BRICS alliance—Brazil, Russia, India, China, and South Africa—is actively developing an independent financial system and exploring a shared currency. These initiatives directly challenge the U.S.-dominated system and could reshape global trade relations, monetary policy, and governance.

The term "BRIC" was coined in 2001 by Goldman Sachs economist Jim O'Neill to describe the rising economic powers of Brazil, Russia, India, and China. In 2010, South Africa joined the group, forming "BRICS." Together, these nations represent over 40% of the world's population and about 25% of global GDP.

Initially an informal grouping, BRICS has evolved into a more structured alliance with annual summits, a development bank (the New Development Bank), and a financial safety net (the Contingent Reserve Arrangement). These institutions parallel Western-dominated ones like the World Bank and IMF.

BRICS nations have been actively working to reduce their dependence on the U.S. dollar through several initiatives:

- Increasing trade settlements in local currencies rather than dollars

- Developing alternative payment systems like BRICS Pay to bypass SWIFT

- Building gold reserves as an alternative to dollar-denominated assets

- Creating financial institutions that operate independently of Western control

- Exploring digital currency solutions based on blockchain technology

At the 2024 BRICS Summit, member nations discussed the possibility of creating a shared currency. Several models have been proposed:

- A settlement currency used only for trade between BRICS nations

- A digital currency based on blockchain technology

- A currency backed by a basket of commodities, including gold and other natural resources

- A unit of account similar to the IMF's Special Drawing Rights

While significant challenges remain, including divergent economic policies and political tensions among member states, the BRICS currency initiative represents the most serious attempt yet to create an alternative to the dollar-based system.

Global Impact & Future Outlook

The potential shift from dollar dominance to a multipolar currency system could have profound implications for global trade, investment flows, and geopolitical power dynamics. Understanding these changes is crucial for policymakers, businesses, and investors.

A shift away from dollar dominance could have several economic consequences:

- Higher borrowing costs for the United States as demand for Treasury securities decreases

- Reduced ability of the U.S. to run large trade deficits without currency depreciation

- More volatile currency markets during the transition period

- New investment opportunities in emerging market currencies and assets

- Potential for commodity price inflation as pricing shifts away from dollars

The currency landscape is closely tied to geopolitical power. Changes could include:

- Diminished U.S. ability to impose effective financial sanctions

- Increased economic autonomy for BRICS and aligned nations

- New patterns of alliance formation based on currency blocs

- Shifts in global governance as Western-dominated institutions lose influence

- Potential for regional monetary zones to emerge around dominant economies

Several possible futures could emerge from current trends:

- Continued Dollar Dominance: The dollar overcomes challenges and maintains its central role, with other currencies playing supporting roles.

- Bipolar System: The dollar and yuan emerge as two dominant currencies, each with its sphere of influence.

- Multipolar System: Multiple currencies (dollar, euro, yuan, BRICS currency) share the global stage with regional specialization.

- Digital Disruption: Central bank digital currencies and private cryptocurrencies fundamentally reshape the monetary landscape.

The most likely outcome is a gradual transition to a more multipolar system, with the dollar remaining important but sharing the stage with other currencies to a greater extent than today.